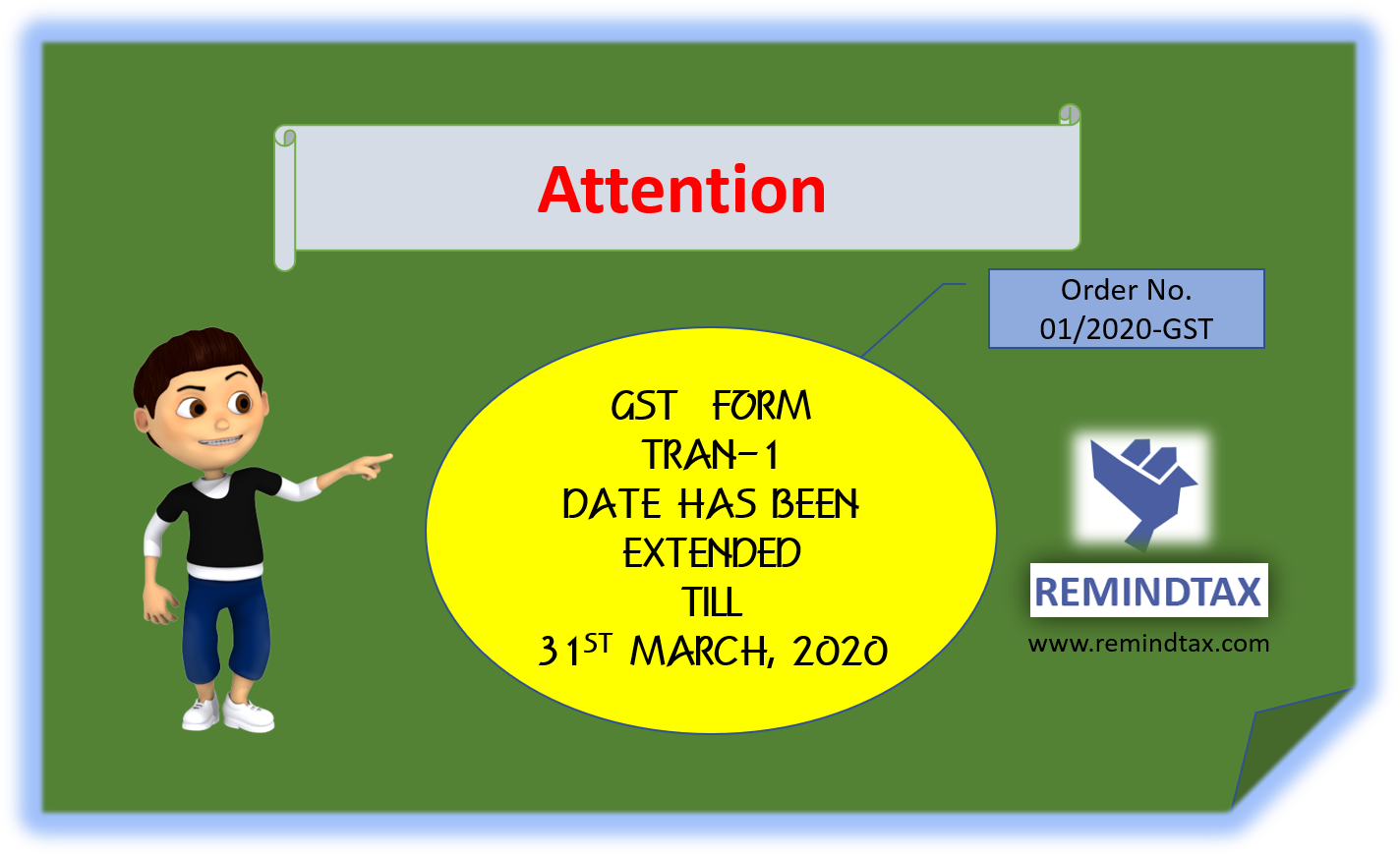

TRAN 1

GST TRAN-1 Last Date further

Extended upto 31 March 2020 in certain cases (Transitional Credit)

CBIC has notified that last date for submission of declaration in Form GST

TRAN-1 has been further extended upto 31 March 2020, under CGST Rule 117(1A), in certain cases recommended by GST Council, i.e.

where registered persons could not submit GST TRAN-1 as per earlier

deadline due to technical issues at GST Portal.

It may be noted that CGST Rule 117(1A) has been inserted vide CGST (9th

Amendment) Rules, 2018: CBIC Notification No. 48/2018 Central Tax dt. 10 Sept.

2018 to accommodate such taxpayers.

Earlier also the deadline was extended under CGST Rule 117/ Rule 120A to submit/ revise the declaration. The

GST Rules/ Form GST TRAN-1 have already been amended in line with

recommendations of the GST Council to once allow revision of declaration in

Form GST TRAN-1 electronically submitted by taxpayers at GST Portal, under

CGST Rule 120A.

Subject: Extension of time limit for submitting the

declaration in FORM GST TRAN-1 under rule 117(1A) of the Central Goods and

Service Tax Rules, 2017 in certain cases

In exercise of the

powers conferred by sub-rule (1A) of rule 117 of the Central Goods and Services

Tax Rules, 2017 read with section 168 of the Central Goods and Services Tax

Act, 2017, on the recommendations of the Council, and in supersession of Order

No. 01/2019-GST dated 31.01.2019, except as respects things done or omitted to

be done before such supersession, the Commissioner hereby extends the period

for submitting the declaration in FORM GST TRAN-1 till 31st March, 2020, for

the class of registered persons who could not submit the said declaration by

the due date on account of technical difficulties on the common portal and

whose cases have been recommended by the Council.